OPPORTUNITY ZONES

Every state has Opportunity Zones, but only Wyoming couples these federal advantages with state incentives like no personal or corporate income tax, low sales taxes, low property taxes and one of the largest sovereign wealth funds in the nation. Added up, those advantages create a stable, reliable environment for business owners.

What are Opportunity Zones?

Opportunity Zones are part of a developmental program that promotes the long-term investment in and development of low-income urban and rural real estate across the United States. The program incentivizes reinvestment in distressed communities by giving investors substantial tax breaks on their capital gains. The tax breaks are based on how long an investment is held with a Qualified Opportunity Fund.

The tracts nominated in Wyoming offer tremendous opportunities for investors and communities, including:

- A range of investment opportunities

-

Businesses – startups, expansion, recruitment

-

Cities, towns, and rural areas

-

Geographic diversity

-

Infrastructure

-

Real estate

-

Research

-

Statewide distribution

To be eligible to be nominated for Opportunity Zone designation, a census tract must meet one of the two following criteria.

- Low-income Community Eligibility: Census tracts must have a poverty rate that is greater than 20% or median family income that is less than 80% of statewide median family income.

- Qualified Contiguous Eligibility: Census tracts must be adjacent to a qualified low-income community that is designated as a qualified Opportunity Zone, and the median family income of the tract must not exceed 125 percent of the median family income of the low-income community with which the tract is contiguous.

Why to Invest in an Opportunity Zone

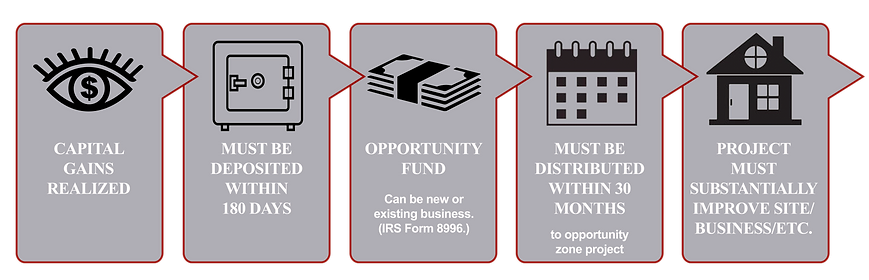

Any taxpayer can defer capital gains taxes by reinvesting those gains in a qualified opportunity fund.

A qualified opportunity fund is an investment vehicle that holds at least 90 percent of its assets in qualified Opportunity Zone investments, including:

- Property (e.g. real estate, equipment, infrastructure) within an Opportunity Zone

-

Stock or equity in a trade or business whose owned or leased property is in a qualified Opportunity Zone

Through a series of base increases, capital gains taxes are decreased through time as the investment is held in the fund. If the investment is held in a qualified opportunity fund for 10 years, the basis of the investment is equal to the fair market value of the investment.