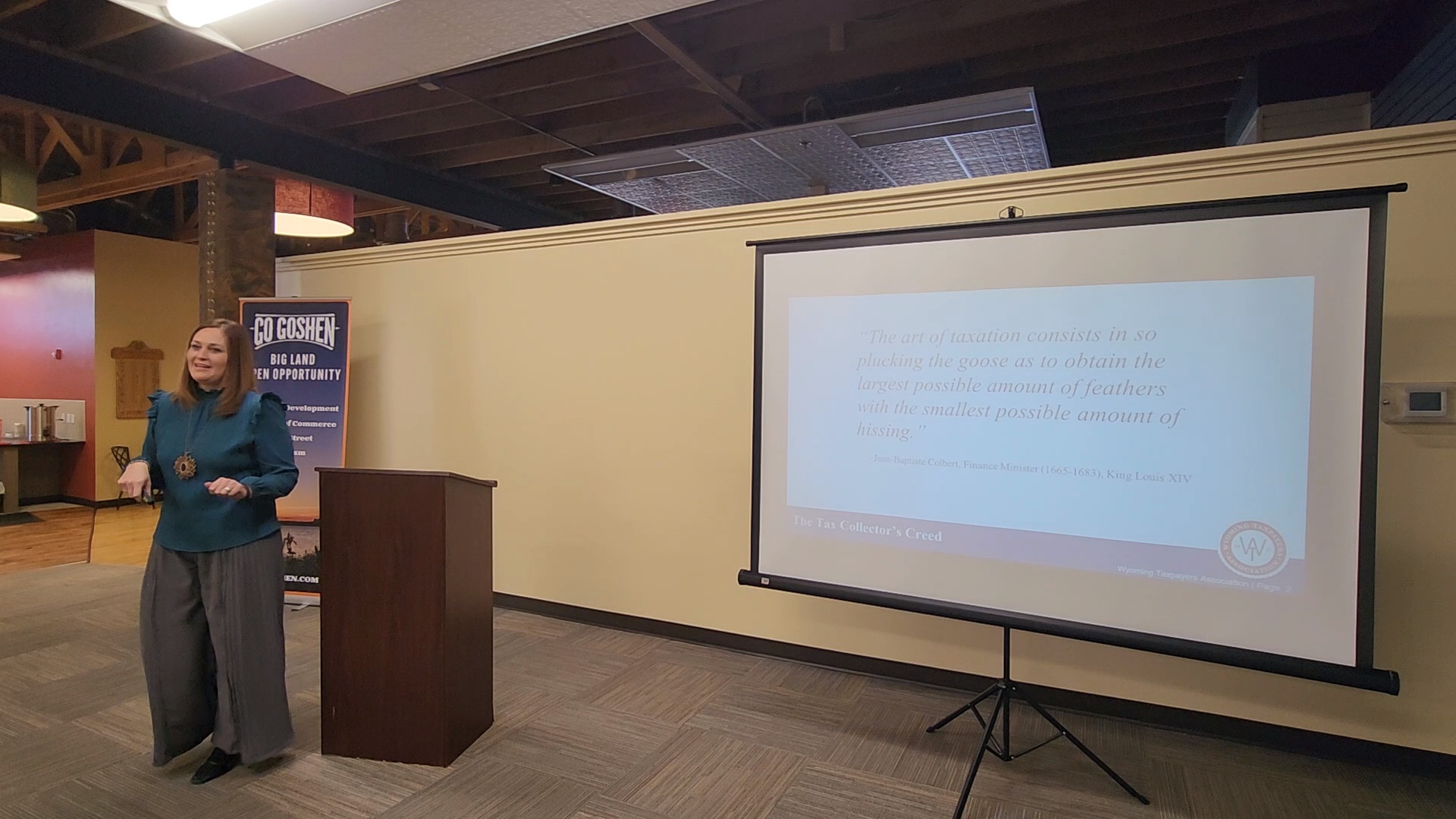

The Wyoming Taxpayers Association (WTA) has been a cornerstone of the state’s economic policy since 1937, advocating for tax policies that bolster a healthy economy. The WTA’s membership, an eclectic mix from individuals to corporates, plays a pivotal role in shaping the tax dialogue. Their principle? Taxes should be justified, equitable, and transparent.

As Wyoming approaches a budget session, the governor’s budget recommendations set the stage, focusing on areas like property tax relief, mental health services, and economic development initiatives. These priorities reflect the broader ambitions of the state to innovate and adapt in a changing economic climate.

Ashley Harpstreith, Executive Director of the WTA shared that in looking at Wyoming’s tax structure, property tax makes up 47%, general sales tax 26%, severance tax 22%, and other taxes at 5% which includes fuel, cigarette, alcohol, etc. Wyoming pays no individual income or corporate tax.

“Just to compare on a national level where we are with residential property tax, it has been an issue all across the United States,” said Harpstreith. “We enjoy the 47th lowest residential property tax.”

Harpstreith continued, “When you’re looking at property these taxes and thinking about the services that we have grown accustomed to, this is one of the main ways that Wyoming residents pay for their services.”

Tax policy, an often-dry subject, is vital to understanding and participating in the welfare of our state. It’s in the hands of informed citizens and diligent lawmakers to craft a tax policy that’s fair, forward-thinking, and reflective of Wyoming’s values and needs.

Budget Session Resources (Slide 22)

State Budget Department – Wyoming State Budget

Consensus Revenue Estimating Group

Wyoming Department of Revenue Annual Report